A downloadable version of this explainer is available here:

This explainer provides an overview of valuation of ecosystem services as a way to measure individual and social preferences including:

- Why it is difficult to apply dollar values

- Non-market methods, including revealed and stated preference methods, and their limitations

- Examples of non-market valuation research questions

- Why value estimates often do not represent the total value of an ecosystem service.

When you see a dollar value attached to an ecosystem service or natural resource, those dollar amounts are derived by economists using valuation methods. These methods come up with dollar values by examining people’s choices (Freeman et al. 2014). Whenever we choose one thing over another, even as individuals, we are engaged in valuation. For example, buying a loaf of bread at a particular price is a choice. If you pay $3 for a loaf, that choice reveals that its value to you is at least $3.

Valuing ecosystem services and natural resources is difficult because we usually don’t buy and sell ecosystem services in the same way we buy and sell bread, cars, and houses. But, the core principle of ecosystem valuation is the same: economists examine choices to reveal the weight society places on ecological goods and services.

In a limited set of cases, we can use market prices as a value measure of an ecosystem service. Examples include the value of a timber harvest or commercial fishing catch because market prices directly reveal something about their commercial value. In most cases, however, we lack direct measures. This is because natural resources and ecosystem services are usually public goods and services—meaning they are not traded in markets and thus lack obvious prices.

Non-Market Valuation Methods and Data

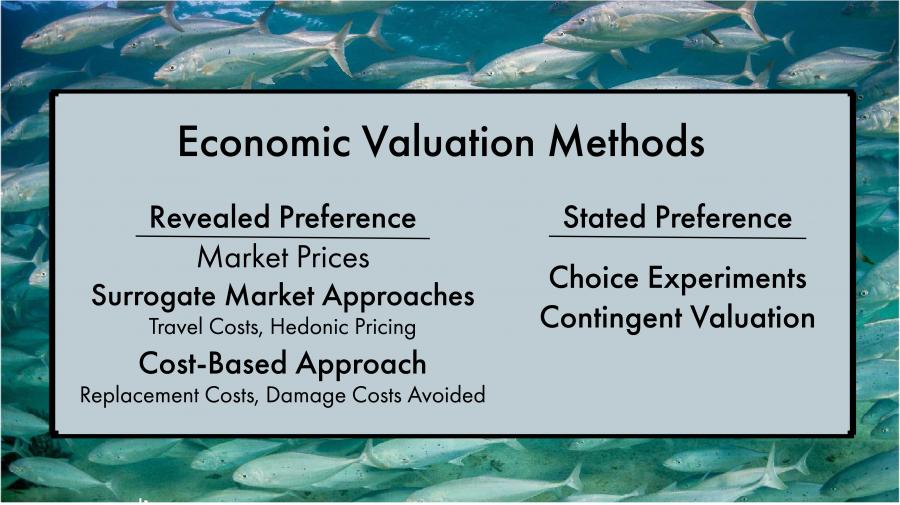

Economists use two approaches to overcome this “non-market valuation” challenge. Revealed preference methods use real-world data about our choices and behaviors to make inferences about our environmental preferences (Bockstael & McConnell 2010). Stated preference methods involve simulated choice experiments where subjects are asked to make choices in a survey or focus group setting (in effect, a sample of people is used as guinea pigs in a valuation laboratory) (Louviere et al. 2000).

An example of a revealed preference method is to look at house prices. The price premium paid (a choice) for living near the ocean, having a mountain view, or being in proximity to urban parks can be measured via statistical analysis (Mahan et al. 2000). Another method focuses on the costs people pay to enjoy a natural resource (Brown & Mendelsohn 1984). When you spend time and money to enjoy nature (such as the costs of traveling to a place), that reveals something about how much you value it. Another technique is to examine costs avoided by the presence of an ecological feature or service (Dickie 2003). For example, if we lose wetlands and lose their water purification or flood damage reduction benefits, we may have to invest in water treatment facilities or levees and dams. If instead we protect the wetlands, we avoid the costs associated with built infrastructure alternatives. Those avoided costs can be a crude, proxy measure of their value.

Stated preference methods are used for valuation when revealed preference data is absent or hard to come by. Stated preference studies present subjects with realistic, but hypothetical, choices. For example, a survey may ask a respondent to choose among scenarios with different environmental characteristics (to understand which are most important) or choose between an environmental amenity and an increase in their household taxes. (Johnston et al. 2002). The virtue of stated preference methods is that they can be designed to measure hard to get at preferences. Their drawback is they don’t involve real choices and real money and therefore may yield less reliable monetary values.

When you use economic value estimates it is important to keep in mind that they often do not represent the total value of an ecosystem service or resource—just the piece of value that can be detected by the method used in the study. For example, a study that reports a parkland’s value based on housing price analysis is only capturing the value of the park to homeowners—it does not account for the office workers, commuters, or tourists who also value the park. Most natural resources are bundles of things that are valuable in different ways to different people. Each piece of value may require a different methodological approach.

Examples of Non-Market Valuation Research Questions

- What is the economic value of groundwater recharge and protection to row crop farmers?

- Do preferences for urban parkland vary among demographic groups?

- Could the social value of a wetland exceed the value of filling it in to build a shopping center?

- What is the social cost (the negative benefit) of removing riparian vegetation?

- Are taxpayers likely to support investment in forest restoration?

- Does a community prefer nature-based green infrastructure alternatives to conventional (gray) alternatives?

Key Takeaways

- Economic valuation is a way to measure individual and social preferences for environmental resources, goods, and services.

- Monetary values are derived by economists using valuation methods and data.

- Valuation methods use data about our choices and behaviors to detect preferences.

- A range of valuation methods is used, and the total value of a resource or service may not be detectable via a single method.

- “Revealed preference” methods explore real-world choices; “stated preference” methods rely on simulated, hypothetical choices.

References

- Bockstael, N.E., & McConnell, K.E. (2010). Environmental and Resource Valuation with Revealed Preferences: A Theoretical Guide to Empirical Models. Springer Dordrecht. https://doi.org/10.1007/978-1-4020-5318-4

- Brown, Jr., G., & Mendelsohn, R. (1984). The Hedonic Travel Cost Method. The Review of Economics and Statistics, 66(3), 427–433. https://www.jstor.org/stable/1924998

- Dickie, M. (2003). Defensive Behavior and Damage Cost Methods. In P.A. Champ, K.J.Boyle & T.C. Brown (Eds.), A Primer on Nonmarket Valuation (vol. 3), (pp. 395-444). Springer Dordrecht. https://doi.org/10.1007/978-94-007-0826-6_11

- Freeman, A.M., J.A. Herriges, J.A., & Kling, C.L. (2014). The Measurement of Environmental and Resource Values: Theory and Methods (3rd edition). Taylor and Francis. https://doi.org/10.4324/9781315780917

- Johnston, R.J., Swallow, S.K., & Bauer, D.M. (2002). Spatial Factors and Stated Preference Values for Public Goods: Considerations for Rural Land Use. Land Economics, 78, 481–500. https://www.jstor.org/stable/3146848.

- Louviere, J.J., Hensher, D.A., & Swait, J.D. (2000). Stated Choice Methods: Analysis and Applications. Cambridge University Press. https://doi.org/10.1017/CBO9780511753831

- Mahan, B.L., Polasky, S., & Adams, R.M. (2000). Valuing Urban Wetlands: A Property Price Approach. Land Economics, 76(1), 100–113. https://www.jstor.org/stable/3147260